federal income tax canada

Federal income tax was initiated in Canada in 1917 to help finance the First World War. 2021 taxes By Tamar Satov on November 4 2021 We break down the tax brackets in Canada for 2021 and provinces too based on annual income.

:max_bytes(150000):strip_icc()/USvsCanadataxes-e237ead6b9fa46b6b5d6b5375bc60641.jpg)

Canada Vs U S Tax Rates Do Canadians Pay More

Your bracket depends on your taxable income and filing status.

. Federal Tax Rates. The struggling economy and a political crisis resulting from conscription triggered its. The rates reflect all 2021 federal provincial and territorial budgets which are usually introduced in the spring of each year.

The higher your earnings the higher your payments. Canada income tax calculator Find out your federal taxes provincial taxes and your 2021 income tax refund. The rates include all provincialterritorial.

There is no age limit for deducting income tax and there. 10 to 37 is the range of. These are the rates for.

Federal income tax brackets span from 10 to 37 for individuals in Canada tax rates are between 15 and 33. 10 12 22 24 32 35 and 37. File taxes and get tax information for individuals businesses charities and trusts.

Average tax rate 000 Marginal tax rate 000 Summary Please enter your income deductions gains dividends and taxes paid to get a summary of your results. There are seven federal tax brackets for the 2022 tax year. Total federal income taxes might be.

Read online free Federal Income Tax Litigation In Canada. 6 rows On 50000 taxable income the average federal tax rate is 1510 percentthats your total. 58 rows Thats in the second tax bracket both federally and provincially.

6 rows How Canadas personal income tax brackets work How much federal tax do I have to pay based. Income tax GSTHST Payroll Business number Savings and pension plans Child and family benefits. Download Federal Income Tax Litigation In Canada full books in PDF epub and Kindle.

What is the income tax rate in Canada. The federal government charges you 15 on the first 49020 you made minus the federal exemption of 13808 and. Federal tax rates range from.

The percentage of your earnings that is taxed is determined by your income and filing status. 350634 42184 at a. Total Taxable Income 50000 Total Deductions 0 Total Income 50000 Total Tax 1098174 Income Tax 765749 EI Premiums 790 CPP Contribution 253425 After.

Income tax As an employer or payer you are responsible for deducting income tax from the remuneration or other income you pay. The personal income tax rate in Canada is progressive and assessed both on the federal level and the provincial level. Federal Income Tax Litigation In Canada.

Estimated amount 0 Canada Federal and Provincial tax brackets Your taxable. 960390 49020 at a 15 tax rate then 10980 at 205 a tax rate Total provincial income taxes would be. Income Tax in Canada vs.

15 on the first 50197 of taxable income 205 on the amount over 50197 up to 100392 26 on the amount over 100392 up to 155625 29. However in the US singles.

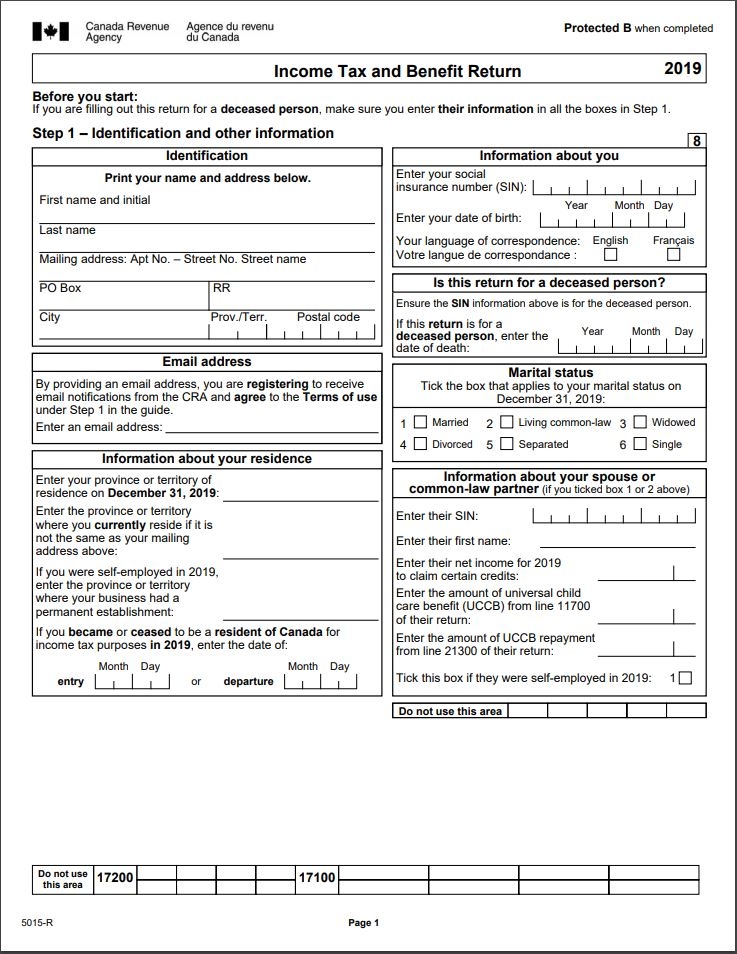

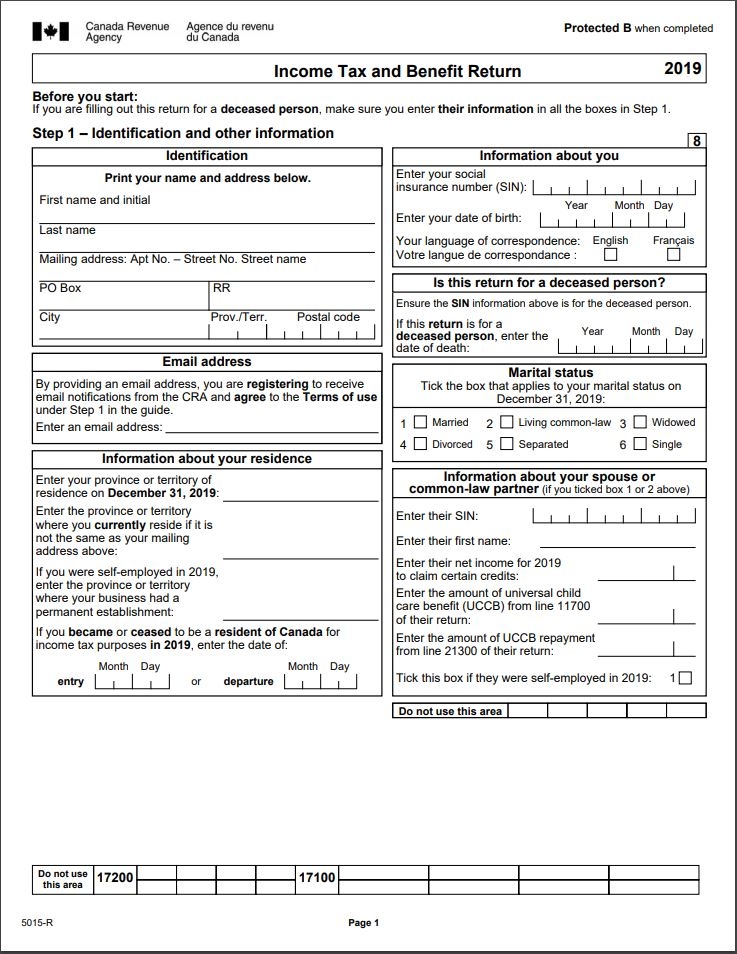

Taxtips Ca Federal 2019 2020 Income Tax Rates

Federal Corporate Income Tax Revenues Actual And As A Percentage Of Download Table

Canada S Rising Personal Tax Rates And Falling Tax Competitiveness 2020 The Nelson Daily

Your Bullsh T Free Guide To Canadian Tax For Working Holidaymakers

Tax Brackets Canada 2021 Rgb Accounting

How Much Tax Does A Non Resident Canadian Citizen Have To Pay Annually To The Canadian Government Quora

Manitoba Tax Brackets 2020 Learn The Benefits And Credits

Pdf The Federal Income Tax Act And Private Law In Canada Complementarity Dissociation And Canadian Bijuralism David Duff Academia Edu

High Income Earners Need Specialized Advice Investment Executive

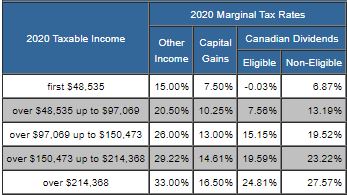

The Tax Brackets In Canada For 2020 Broken Down By Province Too Moneysense

Summary Of The Latest Federal Income Tax Data Tax Foundation

Personal Income Taxes In Canada Revenue Rates And Rationale Hillnotes

Where Your Tax Dollar Goes Cbc News

Table How Your Federal Income Tax Will Change Under Trudeau S 2016 Tax Plan R Canada

Personal Income Tax Brackets Ontario 2020 Md Tax

Taxtips Ca Personal Income Tax Rates For Canada Provinces Territories

Worthwhile Canadian Initiative 150 Years Of Federal Consumption Taxation

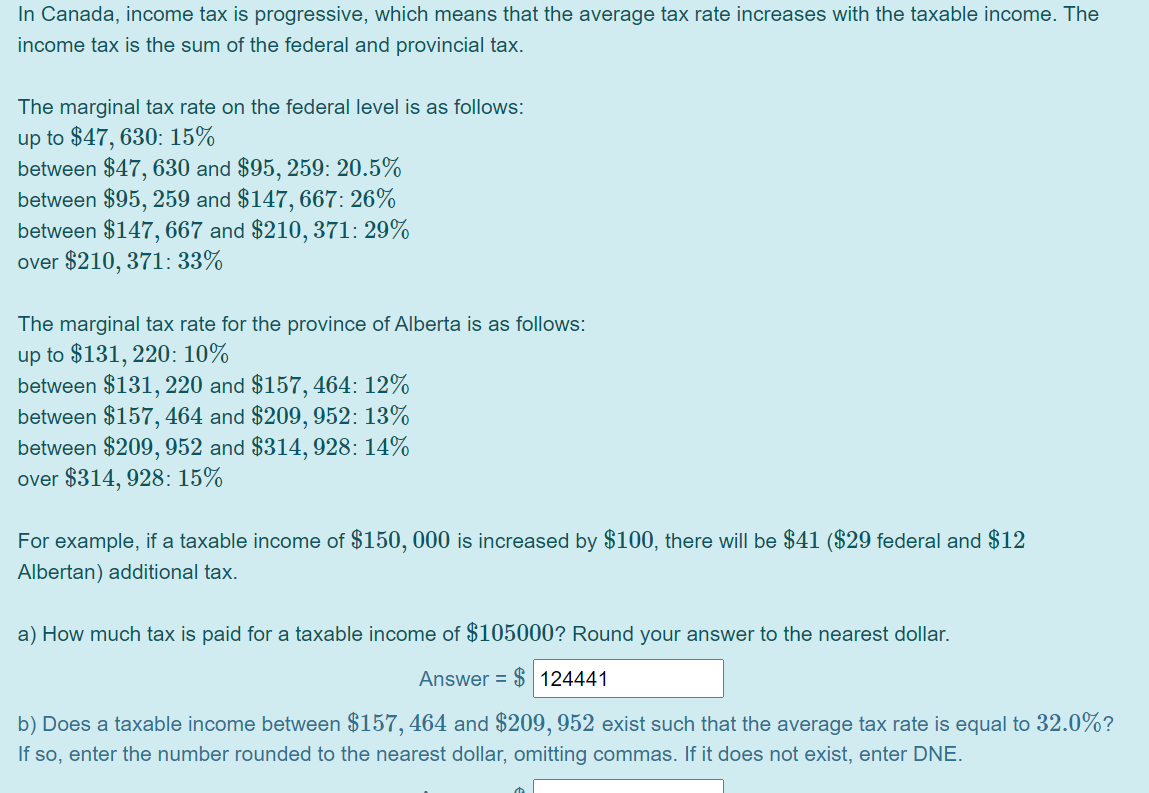

Solved In Canada Income Tax Is Progressive Which Means Chegg Com

B C Top Income Tax Rate Nears 50 Investment Taxes Highest In Canada Coast Mountain News